Kiwis used to do this sort of thing well; we would go out of our way to help people who needed it. As a country we have always prided ourselves on being small but efficient.

Have we lost that? And what else have we lost? – Tracy Watkins

So here’s my wish for 2023, though it’s the same as last year. That we have a serious conversation about this country’s future, and a pathway through; that we debate a future for our young people without resorting to soundbites, cheap shots and populism. – Tracy Watkins

I’m passionate about stories because stories reach out and help people to make decisions about their own lives.

It’s fiction and stories that are a unique human capacity. It’s only humans who can understand fiction. It’s only humans who can understand the metaphors of music or understand the way a movie can help you make a decision to change your own future. – Dame Miranda Harcourt

We all understand the power of great teaching and how that can lift somebody out of themselves to achieve their ambition and to be the best person they can be.

“That’s what I aim to do is use the tools of great teaching to help actors achieve an inspirational performance because then, of course, it reaches out and inspires people all over the world when they see it and creates change in itself. – Dame Miranda Harcourt

Since 2013, some 2800 medicines have been listed in Australia. That’s almost one a day. For New Zealand, we have funded a trifling 350 medicines for the same period. And yet in Australia there is very little fanfare accompanying medicine funding announcements, unlike Pharmac boasting it is funding a drug it considers “new”.

Why? Because in Australia, their governments see the public funding of medicines as a right, whereas in New Zealand, governments see it as a luxury. – Dr Malcolm Mullholland

All of this uncertainty and lack of transparency leaves patients wondering what’s changed. Pharmac’s arrogant and out-of-touch culture is still there for everyone to see, resulting in the Minister being left red-faced and having to provide media advice to the Crown entity he is responsible for, on how to make public health announcements. As well the minister overturned, in the lead-up to Christmas, the agency openly considering depriving children of cancer medicines.

Pharmac’s perverse culture aside, patients want to know what each political party is prepared to do with Pharmac as the election draws closer. Will Pharmac come under Te Whatu Ora, rather than continue to be a law unto themselves?

Will they heed the advice of the review and amend Pharmac’s statutory objectives? Will they instruct Pharmac to follow Treasury’s wellbeing framework? Will funding decisions have a timeframe that Pharmac will be held accountable for?

The biggest question is how much money are they prepared to give Pharmac? – Dr Malcolm Mullholland

It should also be clear that unless Pharmac is funded properly, its wish list of over 70 medicines will continue to grow with no plan as to how it might fund the other 280 medicines grinding their way through Pharmac’s notoriously slow process.

Even if Pharmac was able to reach the dizzying heights of putting a dent in trying to be average in the OECD by funding all 350 medicines that sit with the agency, we are still miles off funding every medicine in the world. That’s how far behind we are.

We should not have to wait another five years or so for a government to better fund Pharmac so that patients can access what are seen in other countries as a valued human right. That is, the right to life. – Dr Malcolm Mullholland

It is a rather curious feature of New Zealand universities today that they swarm with quite a lot of part-Maoris who share a set of common practices somewhat at variance with the free and open exchange of accurately established knowledge. – Bruce Moon

Falsely posing as the victims of British colonisation and harking back to a non-existent Maori paradise of the past has brought rich, and far too often, illegitimate, material gains to some people of part-Maori descent and great damage to democracy in New Zealand. – Bruce Moon

The genius of a horoscope is ambiguity. – Damien Grant

Alas, forecasts by newspaper pundits are as worthless as horoscopes. What we scribes for shillings lack is the ability to see the unseen, so we tell you the obvious. – Damien Grant

For myself, I believe we are on a turkey farm. It is my view that the economic path we have been following since the GFC has been setting us up for a massive economic correction on a scale similar to 1929.

I think that when this happens democratic governments will react in the same heavy-handed way they did then, in the same oppressive way they did in response to the pandemic, and that this will exacerbate the economic calamity into years of disruption and misery. – Damien Grant

How can you step back and look at the explosion of sovereign debt, unwinding of decades of monetary prudence combined with sustained disruption in the global supply chain and, oh, a massive war in the heart of Europe, and not conclude that there is risk of total economic collapse?

The west has been reduced to an economic model where business is sustained by consumer spending funded by debt and maintained by printed cash. It cannot continue and it will not continue. Something has to give. Of course, it is possible that we can navigate a path forward that does not involve wiping out the pension savings of two generations and eviscerating the economic fundamentals that sustain those on the margins of economic life; but isn’t at least possible that we can’t? – Damien Grant

I still consider being a school teacher is perhaps the most noble and ennobling career that anyone can have, especially the teachers of the smallest children …like kindergarten teachers, preschool educators and mothers. – Dr Sir Haare Williams

As we look into the New Year, there are a lot of crucial issues facing the country – how do we deal with the ongoing unaffordability of housing (notwithstanding the recent fall in house prices); how do we increase our rate of productivity growth so that we can afford the good things of life that wealthier countries take for granted; how do we improve the serious problems in our education and health sectors; how do we deal with the longer-term fiscal crisis caused by our ageing population.

But of all the problems we face, perhaps none is as important as this: do we want to continue to be one of the few democracies in the world where every citizen has equal political weight, or do we want to become a society where political influence is determined by who our ancestors were? – Don Brash

The increasing use of Maori words in official documents, on signs and in taxpayer-funded media is nuts if it is intended that most of the population understand what is intended. I have always supported taxpayers’ funds being used to support the teaching of the Maori language to those who wish to learn it. But it is crazy to imagine that the Maori language will ever be more than a curiosity, in much the same way that some Catholics still hanker after the continued use of Latin. New Zealand is hugely fortunate that English is our primary language, as it is the nearest thing there is to a truly international language. Using taxpayers’ funds to teach kids who can’t read and write English effectively how to speak a few words of Maori is crazy. – Don Brash

Before Europeans arrived in New Zealand, Maori society was very basic by any standard – no written language, no wheel, no metal tools, no concept of legal ownership, widespread cannibalism and female infanticide. The inter-tribal Musket Wars of the early part of the nineteenth century resulted in a massive loss of life – more deaths in the few decades before 1840 than in all the subsequent wars that New Zealanders have been involved in.

The Treaty of Waitangi was intended to put an end to that, and was eagerly sought by many of the tribal leaders as a way of ending those inter-tribal wars (and perhaps as a way of fending off a French conquest). It involved the chiefs accepting the sovereignty of the Queen, and being guaranteed in return the full possession of their property and “the rights and privileges” of British subjects. In other words, the Treaty unambiguously guaranteed all New Zealanders equal rights.

Indeed, if it had not guaranteed equal political rights, we would now have to discard it and start afresh because there can be no lasting peace in any society where some citizens have a preferred political status by virtue of birth. – Don Brash

Today, diversity in our formal cultural outlets, from gallery and libraries to publicly funded arts, is measured by identity much more than by social or economic class, lived experience or diversity of values.

Working people are seen in crises and crimes. Formal culture is about working class people more than it is of or for them. Those of us eating the wrong food, driving the wrong car, or having the wrong views apparently need to be corrected and educated. – Josie Pagani

Lest you think I am attacking straw people, there is a cultural purge in our elite institutions. – Josie Pagani

What is really going on is a form of cultural cleansing: Local is more valuable to us because it ‘’tells our stories’’. But our cultural institutions are telling only some of our stories.

Local is not always more relevant. The music of the Beatles, Adele, Mozart and Ed Sheeran is more relevant to us than Kāpiti driftwood art. The Rolling Stones and Beethoven are global because of their excellence.

Editorial choices will always be needed. Cultural collections need to be curated. My argument is not against selection, but against chauvinism.

If we want to understand which of our creators are genuinely excellent, we need to expose ourselves to world-class alternatives so that we can understand what makes the best as good as they are. – Josie Pagani

We are a culturally divided country. Trust in the media is dropping, particularly among people with more conservative views. You might not worry if your views are left, but it does matter in our democracy if a chunk of citizens don’t feel represented. – Josie Pagani

Today, 55% of New Zealanders regard the media as a “dividing force” in society, against 23% who saw it as ‘’unifying’’.

Intellectual conformity in our elite cultural institutions is leading to division in New Zealand. – Josie Pagani

It would be too easy, however, to attribute Britain’s manifold problems to one man’s incompetence and lack of principle. This would be to evade thinking about the deep cultural roots of the country’s present malaise, some of them traceable, it is true, to past political choices: but when policies are entrenched, they become cultural.

The opposite of frivolity is not seriousness but earnestness, which is, if anything, even worse than frivolity, for it persuades the earnest that they are working with the best of intentions and dissuades them from consideration of the actual effects of what they do. Earnestness is a kind of moral chain mail that protects against the slings and arrows of outrageous criticism. It also encourages an unholy alliance between sanctimony and self-interest. It dissolves the distinction between activity and work.

In Britain, under the influence of earnestness, a collapse has occurred in the standard of public administration, such that it now inclines both to bullying and ineffectiveness, to making an immensity of shadow work and avoiding real work. Public administrators have found the secret of being frantically busy and doing nothing at the same time. Hypertrophy of rules and interference go hand in hand with anarchy and inefficiency. Those who work in the public administration or are paid from the public purse are assured of pensions of which those who do not work for it or are not paid from it can only dream: and they believe, of course, that they deserve this immense privilege, for, unlike others, they have worked all their lives for the public good rather than for private advantage. That the administrators are protected from the hazards of inflation by their index-linked pensions naturally gives the rest of the population the impression that the people are now there to serve the government, not the other way around.

Every day, one encounters evidence of the incompetence and unseriousness of the public administration, of activity without real purpose. – Theodore Dalrymple

At every turn in Britain, one discovers the same lack of straightforward intellectual and moral probity, a form of corruption worse than the financial kind, insofar as the latter is—in principle, at least—easy to correct. But to correct moral corruption, once it takes hold, is like trying to unscramble an egg. – Theodore Dalrymple

The investigation and adjudication of complaint in a quasi-judicial manner is the perfect instrument for increasing the powers of administrators. That is one reason it wants its workforce, those in subordinate positions, to be as supersensitive to racism and bullying as possible, defining both racism and bullying by the perception of the supposed victims, often requiring no objective correlative of the accusation. This creates an atmosphere of constant suspicion, mistrust, fear, and pusillanimity throughout the institution and promotes the very phenomena it is supposed to reduce or eliminate, for nothing intimidates as much as the threat of being found guilty if accused. While such an atmosphere is hardly conducive to securing the aims of the institution—in the case of universities, high-level teaching and research—one should remember that these are not the aims of the administration. Wokeness is the perfect ideology for the hegemony of an administrative class that it would be an insult to much of humanity to call mediocre. – Theodore Dalrymple

The commissars of equity, diversity, and inclusion had so insinuated themselves into every committee and every hiring decision that they were like spies. For a man who had achieved his eminence by dint of ability and hard work, at a time when, however imperfect, these things still counted for more than the dark arts of bureaucratic ascension, and who still valued the primary academic goals of universities, life became intolerable. He left the university, which he had tried to serve faithfully. It was now a place in which saying what one did not believe was obligatory and saying what one did believe was forbidden, as has always been the case in any totalitarian country: and this in an institution supposedly dedicated to the search for and propagation of truth! – Theodore Dalrymple

Before the professor left the university, the Department of Human Resources, already a horrible renaming of the Personnel Department (the humble issuer of employment contracts), had become the Department of People and Culture, a name that out-Orwells Orwell. One of its functions, presumably, was to prevent, sniff out, or punish thoughtcrime in the university and to eliminate culture as it was once conceived.

None of the above, alas, is in any way unexpected or unusual nowadays. On the contrary, it is the “new normal.” The atmosphere of suspicion, fear, querulousness, lying, hypocrisy, pusillanimity, denunciation, and paranoia, all in the name of some vaguely defined justice, that Conrad describes in Russia before its second revolution (which, of course, made all of it a thousand times worse), is now commonplace. In human affairs, there is no new thing under the sun, and examples of almost anything can be found in history: it is prevalence of things that changes. I do not recall ever having lived in so pervasive an atmosphere of untruth as that of the present. It is as if a demon of untruth had not merely insinuated itself into institutions but into men’s souls. The faculty of truth, like all other faculties, withers with disuse. A kind of cynical skepticism results, leaving power as the only reality—exactly as Nietzsche suggested. – Theodore Dalrymple

I suggest, though, that the incontinent expansion of tertiary education has much to answer for, producing graduates whose knowledge or skills are divorced from any real economic function. (I am not suggesting that the only purpose or function of education should be economic.) The economy must somehow absorb these graduates, despite their economic uselessness, or they would become dangerous, like the underemployed lawyers of the French Revolution. The easiest way to employ them is by expanding bureaucracy, and extending regulation serves this end. Wokeism encourages this expansion, for it can make indefinitely shifting and imperious demands in the name of righting wrongs, many yet to be discovered. – Theodore Dalrymple

These processes are not unique to Britain. In hospitals, schools, and universities in the United States, the overgrowth of bureaucracy has been startling. But Britain is peculiarly susceptible to the retarding effects of this frivolous but earnest bureaucracy. It has little industry left; it imports half its food and much of its energy. It has a large public debt, much underestimated in size because it does not include public-pension liabilities. It has run a government deficit for decades; its commercial deficit with the rest of the world approaches 10 percent of GDP. Private debt is astronomical. Both government and individuals are addicted to living beyond their means, the country consuming far more than it produces, a profligacy achieving the status of a custom. It is hard to think of strengths that might offset these defects.

This, then, is a time for seriousness—but what we will likely get is earnestness as the handmaiden of overweening personal ambition, the looting of the public purse, and a spiral of impoverishment. – Theodore Dalrymple

The biggest problems in New Zealand’s schooling system are poor literacy and numeracy. This results from factors such as too little direct instruction as compared to child-led learning, inadequate use of phonics, and “fads” such as modern learning environments. We also lack a knowledge-rich national curriculum that gives all New Zealand students a good educational start in life, and with this a basis for democracy and civil society. The evidence is that socio-economic background is the main determinant of differences between Māori and non-Māori educational achievement.

Given all this, it is surprising how much emphasis the Ministry of Education (MoE) is giving to race as a key variable in education. MoE seems more focused on promoting Māori racial and cultural identity than, for example, professional identities. “Māori succeeding as Māori” is a recurring trope. A wisely sardonic Māori kuia once said to me that New Zealand has too few Māori in the professions and too many professional Māoris (sic). This was decades ago, and she spoke in a whisper. By now the prevailing zeitgeist will have silenced her completely. – Dr Peter Winsley

In MoE documents references are made to te Tiriti creating an equal partnership between chiefs and the Crown. However, it is impossible for Māori to be both subjects of and equal partners with the Crown. The “equal partnership” argument is a modern invention absent from the 1840 documents and devoid of credible scholarship.

MoE contends that te Tiriti includes “a promise that Māori would retain their sovereignty (tino rangatiratanga)”. Equating ‘sovereignty’ and ‘tino rangatiratanga’ is invalid. Article 1 of the Treaty/Te Tiriti transfers to the Crown “sovereignty” (in English) or in Māori “kawanatanga” (governorship). Māori acceptance of Crown sovereignty is clear from records of debate among Māori at the Treaty signings in 1840, from the later discussions at the 1860 Kohimarama conference, and from many other sources.

Tino rangatiratanga protects Māori property rights and reflects Magna Carta principles. It could also mean economic self-determination at the individual, whanau and hapu level. However, it cannot mean sovereignty and the right to make laws as set out in Treaty/Tiriti Article 1. – Dr Peter Winsley

MoE assumes two major “ways of knowing” in New Zealand: science and mātauranga Māori. However New Zealand has long been a multicultural society. Every ethnic, racial or cultural group has a different body of traditional knowledge and belief. This is typically shaped by past learning, the wider physical, technological and social environment, and the influence of ideas, technologies and flows of knowledge from other people and from cross-disciplinary sources.

MoE documents show little real interest in the traditional knowledge and beliefs of New Zealand’s large Asian and other minority (non-Māori) cultures. However, people from these cultures tend to succeed through their own endeavours. – Dr Peter Winsley

All advanced countries invest substantially in science that transcends cultures and is universal. Science follows agreed disciplinary rules internationally rather than local and culture-specific rules.

As Diamond (1997) noted, people in Eurasia and parts of the Americas had the domesticated crops and animals to support economic surpluses, and the trade and other connections to learn from others. However, isolated and migratory groups were limited by their resource base and poor access to new technology and ideas. Some such groups became so isolated that their technological capabilities stagnated and sometimes went backwards. Aboriginal Tasmanians gave up bone tools and fishing gear. Polynesian societies lost pottery-making skills, and Māori whose ancestors sailed to New Zealand on multi-hull sailing canoes (waka hourua) reverted to single hull canoes and forgot how to build and sail larger ocean-going vessels. – Dr Peter Winsley

Before European contact, Māori had no trade connections with the outside world that could open up access to new ideas and technologies. As a result, New Zealand Māori delivered no significant innovation in 800 or so years of pre-European settlement. This had nothing to do with lack of curiosity or intellect. Had the Māori population included Thomas Edison, James Watt, Tim Berners-Lee, Bill Gates, Ross Ihaka and Steve Jobs they would still be “sucking the cold kumara” in abject poverty because the conditions for science-based innovation were absent.

Science aims to continuously advance knowledge and seek universal truth. In contrast, much traditional knowledge or belief such as mātauranga Māori is local. MoE states that “a mātauranga Māori programme will be locally based, drawing on the knowledge and understanding of the iwi and hapū of the locality where the schooling is located. For an interface between mātauranga Māori and science to be successful, a science programme should also be locally derived.”

MoE’s support for a local focus for mātauranga Māori is intellectually limiting, hampers scalability, and reduces the generalisability of the learning undertaken. It also undermines the vision of a national curriculum that delivers powerful knowledge to all New Zealand students on an equitable basis. – Dr Peter Winsley

Mātauranga Māori is proposed to be woven into our national science curriculum. This may create risks when science and myths are confused. For example, no “mauri” or indeed any other “life force” exists within inanimate objects. Therefore, including such concepts in any science curriculum harms students’ education.

New Zealand graduates need to compete in domestic and international marketplaces. Our qualifications need to be respected internationally and remain portable to other countries. We may value mātauranga Māori, however we cannot expect it to be valued outside New Zealand.

Science involves understanding of how and why things work as they do. It is not limited to learning what is, but also why things have come to be. Knowing how to prepare karaka berries is knowledge; trying to find out why and how they are poisonous, and how preparation removes the poison, is science that can then be a platform for other applications It is these platforms that achieve scalability and leverage off rapidly diminishing marginal costs.

Traditional knowledge is rarely accompanied with a deeper understanding of causation. However, such knowledge can trigger rigorous scientific analysis that can lead to significant advances. – Dr Peter Winsley

Science needs connections to others’ research, and reliable ways of storing and disseminating information. Oral cultures require ways of organising knowledge so it can be transmitted through the generations. – Dr Peter Winsley

In Māori culture whakapapa became a means of structuring knowledge and facilitating its recall. Māori also encoded useful knowledge in memorable tales. An example is the story of Mahuika’s fury with Māui for wasting her nails and flame, with her last embers deposited in the kaikomako tree. This tale reminds future generations that kaikomako wood can be used to make fire.

Fundamental to New Zealand’s future is its capacity to engage with and learn from the wider world. We must be an open society and be part of the global “Republic of Science”. Our science must be delivered in the language and style appropriate to people overseas. If we talk only to ourselves no one else will listen and over time we will have nothing left to say.

Some argue that mātauranga Māori knowledge can only be known by those inside Te Ao Māori and skilled in kaupapa Māori. It is fundamental in science that no knowledge is protected from challenge, including from outsiders. Knowledge that requires protection is belief, not science. – Dr Peter Winsley

A risk we are creating is that some of New Zealand’s finest minds may be diverted into ideological “research” and political advocacy and fail to develop fully their skills in critical reasoning and rigorous scientific method. Society may reinforce this while it is the prevailing zeitgeist, and then it will walk away, leaving misled graduates in the wrong fields with devalued degrees and angry with a system that duped them.

Mātauranga Māori reflects what Māori have learned or come to believe through centuries of observation. Beliefs that are erroneous need to disappear and not be protected. While mātauranga Māori resulting from observation of environmental processes can be ongoing, modern scientific method has taken over from most traditional “ways of knowing and believing” internationally. Rather than funding mātauranga Māori we will get more value from applying modern science to the priorities Māori and other New Zealanders have and engaging more Māori in outwards-looking science that matters for the world. – Dr Peter Winsley

It is great that science and ways of learning are stirring increasing interest in the Māori community. We should manage science education so we deliver more people of the calibre of Shane Reti, Ross Ihaka and Garth Cooper. We must avoid creating a generation of embittered identarians who blame all that is wrong with their lives on “western science” and colonialisation. – Dr Peter Winsley

We are now at a point where we are not a rich country, we’re a country that needs to get rich if we’re going to have as many nurses per capita as Australia, for example. I do think that we’re in a fight to maintain being unequivocally a first-world country – David Seymour

As we watch the Chinese Government transition from its old, hardline, Covid-19 elimination strategy, characterised by long and uncompromising lockdowns, to a new, laissez-faire, wide open borders (and bugger the health system) strategy, uncannily like our own, we have confirmation that not even the totalitarian regime of Xi Jinping’s Communist Party can operate indefinitely without a social licence.

Not that our own government is returning the compliment by acknowledging the lack of genuine social licences for its own flagship policies – and changing them. There is more than a whiff of totalitarian indifference to public opinion in the Labour Caucus’s blunt refusal to change course on Nanaia Mahuta’s Three Waters project. – Chris Trotter

Undeterred, Labour doubled-down. Constitutional conventions became confetti. The co-governance provisions of Three Waters became stronger and their likely impact on Māori-Pakeha relations even more divisive.

And this situation looks set to be made ten-times worse the moment the public cottons-on to the fact that the cost of borrowing the billions required to “fix” their drinking-, storm- and waste-water systems is to be extracted from the pockets of the poor schmucks who “own” – but do not control – the four vast “entities” at the heart of the Three Waters project. A bitter realisation, that will hit home about the time they open their new-fangled water bills. – Chris Trotter

Russia’s bloody invasion of Ukraine has dealt what looks like being the final death-blow to the “international rules-based order” overseen by the United Nations. What we deplored, then ignored, in Syria, has come home to the cursèd bloodlands of Eastern Europe.

The global economic system, already rendered dangerously fragile by the financial measures required to fight the Covid-19 pandemic, has received a vicious kick in the gonads from Russia’s combat boots. Rising inflation has ignited multiple cost-of-living crises – even in the world’s wealthiest countries – precipitating social and political conflicts not seen for nearly half-a-century.

But Vladimir Putin’s aggression has done something else. It has stimulated martial feelings long thought dead and buried in the materially abundant (but spiritually impoverished) societies of the West. – Chris Trotter

When the heroism and sacrifice of war seem preferable, and more honourable, than an enervated peace, it is, truly, a terrible year. – Chris Trotter

2022 may have exposed the terrifying scale of Big Tech censorship, but events this year also reminded us of the incredible power of free speech – to unsettle, and perhaps even to topple, our authoritarian elites. So, here’s to 2023 – and to being the dread of tyrants. – Tom Slater

We were told: you have no other option but to surrender. We say: we have no other option than to win. – President Volodymyr Zelenskyy

The march of moral relativism has not made a freer, more content society but an agitated, uncertain one. Post-truth, post-reality, even post-biology, the individual is not liberated, but lost, left utterly alone to ‘arrange things reasonably for himself’. – Brendan O’Neill

Nothing is good or bad in itself, everything depends on the consequences that an action allows one to foresee.’

We see this cult of calculation everywhere today. Industry and growth are judged not according to whether they will be good for us, but through the pseudo-science of calculating their impact on the planet. Human activity is likewise measured, and reprimanded, by calculating the carbon footprint it allegedly leaves. Parenting has been reduced from a moral endeavour to a scientific one – you must now follow the calculations of parenting experts and gurus if you don’t want your kids to be messed up. Benedict was right about our world of calculation – it chases out questions of morality, truth and freedom in preference for only doing what the calculating classes deem to be low-risk in terms of consequences. When everything is devised for us by a calculating elite, freedom suffers, said Benedict – for ‘our freedom and our dignity cannot come… from technical systems of control, but can, specifically, spring only from man’s moral strength’. – Brendan O’Neill

No, I do not share Benedict’s belief in God. I am an atheist. But Benedict’s agitation against the idea that humanity is a consequence of evolution alone was a profoundly important one. A key part of today’s functional rationalism is evolutionary psychology, a science particularly beloved of Dawkinites and the so-called Intellectual Dark Web. It holds that virtually everything human beings think and do can be explained by evolutionary processes, as if we are indistinguishable from those monkeys that first came down from the trees; as if we are propelled into tribal affiliations and warfare and sex by traits stamped into us by the ceaseless march of nature. This, too, chases out the small matter of morality, the small matter that we have risen above our nature and now really are ‘more than all other living beings’, in Benedict’s words. We are capable of choice, we are capable of good. Good – a terribly old-fashioned concept, I know. – Brendan O’Neill

What makes man wonderful?’, argued humanists and theologians in the past. ‘Why is man so shit?’, ask the rationalists of the 21st century. Against their technocracy, misanthropy and evolutionary fatalism, Benedict made a searing cry: human beings are special, human beings are good. This atheistic humanist, for one, found more to cheer in the reason espoused by that Pope of Rome than I did in the petty anti-religiosity of educated secularists. It is no surprise to me at all that some of the heavyweight ‘rationalists’ of the God Wars – Philip Pullman, Stephen Fry – have now fallen for the cult of genderfluidity, a religion infinitely more unhinged than any of the great world religions. This treachery of the rationalists confirms that their guide was not humanistic reason, but mere hostility to religion, especially the Catholic one. If you want to understand reason and truth and why they are so central to human exceptionalism, read not Fry, but Benedict. RIP, Your Holiness. – Brendan O’Neill

How easily we assume that the underdog has virtues, more or less ex officio, as underdog, despite the many times that we learn or discover to our dismay that the underdog, once he becomes top dog, has (at least incipiently) precisely the same vices as the people who previously and until recently persecuted him! The small nation that is liberated from the tyranny of a larger nation immediately begins to oppress a smaller nation. How often has the first fruit of freedom for some been tyranny for others! The drive to tyrannize is a strong one that requires conscious efforts to subdue. I feel it in some small way myself, and consciously suppress, not always successfully, it when I do.

That is why we often find egalitarians to be among the most determined of dominators, who espouse in theory and at a distance what they are unwilling or unable to practise near to themselves. – Theodore Dalrymple

As we enter 2023, we desperately need to cut the technocrats down to size. The great lie of technocracy is that the experts are best placed to make decisions in the national interest. That they somehow stand above the wayward passions of the electorate or the ideology of elected representatives. In reality, technocrats tend to simply pass off their own prejudices as superior insight. – Fraser Myers

The challenges of our times call for fresh and bold thinking, not plodding managerialism or discredited groupthink. What we need is for the public to be brought back into politics, not relegated to the sidelines or treated with suspicion. This year, we must take on the technocrats. – Fraser Myers

A tactical withdrawal is said to be the most difficult of all military operations. A commander has to take his troops backwards while maintaining contact with the enemy and not being pushed into headlong retreat. The challenge is to not lose discipline during the operation.

It can become necessary when the enemy is simply too strong and an army needs to leave the battlefield to avoid a crushing defeat, or it can be simply to pull back to reach an area that is easier to defend.

Trailing National in the polls, Ardern has decided to retreat and present a smaller target to opponents by postponing the implementation of contentious policies or reducing their scope. – Graham Adams

Despite the Prime Minister predictably painting a retreat as a result of her government having ambitiously taken on too many issues to deal with adequately, it is obvious she is making a virtue of necessity.

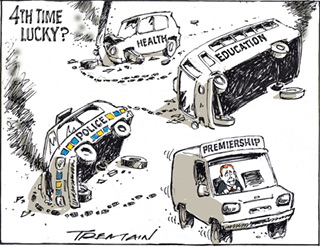

Alongside the government’s well-deserved reputation for being incompetent in delivering even the basics of what the public wants — including roads free of potholes — it seems to have a perverse desire to give them what they don’t want, not least an expensive unemployment insurance scheme and a merger of RNZ and TVNZ.

Desperate times call for desperate measures, but not everyone is convinced Ardern’s prescriptions will help. – Graham Adams

Having been humiliated by her own Minister of Local Government as well as being snookered by the leader of a minor party in short order, Ardern is looking like she belongs to an unfortunate group of commanders — a general whose luck has run out. – Graham Adams

My mother, Valerie Davies, used to remind me when my babies were crying or not sleeping that it was their only way to tell me what they needed. And babies need company and cuddles. Wriggling away from a nappy change or spitting out food wasn’t to annoy but to communicate their likes and dislikes before they could talk.

She had a simple rule: unco-operative or misbehaving children were usually either tired, thirsty, hungry or needed a cuddle and it’s amazing to this day how often it’s true! – Victoria Carter

Imagine not being able to say how you are feeling because no one in your family has helped you understand your feelings of sadness, anger, hurt or puzzlement. What would it be like to never hear regular encouragement or praise, just know a clip on the ear? – Victoria Carter

The police spend more time on family harm incidents than anything else. Every three minutes, on average, the police are called to one. And don’t forget it’s widely believed most of it is not reported.

The more reading I did the more I thought how bloody obvious it is: that if a small child is exposed to violence – either being hit themselves or seeing family members being hurt – moves house regularly, doesn’t get enough food, has no routine, their development is impacted. What was really disturbing was the new research on brain development or lack thereof from the home environment. – Victoria Carter

We need to restore the mana of parenting. We need a social movement for this purpose, it’s not a moral judgment but based purely on what we know from research and science. Emotionally responsive nurturing, especially from birth to around 3 is vital for the healthy development of the brain. – Lesley Max

Nearly 30 years ago the British Medical Journal identified parenting as the most important public health issue facing society … not much has changed in the intervening years. – Lesley Max

If we know this, when are government agencies going to develop strategies to better support good parenting? When are we as a community going to say stop the hitting, any kind of violence? When are we going to agree the most important job is bringing up healthy children and put in steps to make sure that the right support structures are there?

If it takes a village how are we going to get that social movement on the mana of parenting? It’s probably the most important job any of us will have.

I want to see political party manifestos that tackle this issue and offer genuine solutions for children and young people to thrive. Instead of the criminal focus this might do more to nurture good citizens. Which political party is going to focus on the beginning – the parenting – rather than focusing on the crime? – Victoria Carter

Perhaps this will come as a shock to purists, but parents — good ones, at least — do not always tell their children the truth. Preparing a person to live in the world as it is, as opposed to the one they might like it to be, does not always involve confronting them with harsh realities. You ease them in, making difficult judgements about what to reveal, what to withhold. This isn’t dishonesty or pandering; I consider it pragmatism. – Victoria Smith

Having grown up in a household where “just being honest” could be wielded as a weapon to make others feel ugly and stupid, I try to take care over what truly needs to be said. Thereare some truths which I consider important but which I know will not stick, at least not yet. I hold them in reserve. – Victoria Smith

My aim as a parent is not to create individuals who echo my own beliefs. I want them to be people whohave the confidence to be questioning in their own right. Plus, I have enough confidence in my own politics to think they can withstand said questioning without recourse to forced compliance. – Victoria Smith

When one person’s perception of reality (usually, but not always, the eldest male’s) is prioritised over everyone else’s, the family is patriarchal. I do not want my sons to grow up in a household in which everyone else either has to gaslight themselves into going along with one person’s truth, or must pretend to do so out of fear.

Young adults who boast of “schooling” their “bigoted” mothers are model patriarchs. They might have won the power play, but they have lost the moral argument. Maybe one day they will find a politics that can bear the weight of scrutiny, ceasing to treat others as mirrors reflecting their politics back at them at several times its actual validity. That is what I had to find for myself, and what I want my own children to discover, in their own time. – Victoria Smith

Were anyone to suggest incorporating the Genesis account of creation into the school science curriculum, it’s certain that such a suggestion wouldn’t even be listened to, let alone taken seriously. Yet the Ministry of Education considers that Maori creation myths should be woven into the NCEA science curriculum.

How can this be possible in a scientifically and technologically advanced First World country such as New Zealand? – Martin Hanson

To most lay people, science is a body of knowledge about how the world works. But to the scientifically educated, it’s the organised process by which such knowledge is obtained. It usually begins with an observation, leading to questions and a tentative explanation. If this can be tested by experiment, it becomes a hypothesis; if not, it remains speculation. If experimental results do not support the hypothesis, it’s back to square one and a new hypothesis must be tested by more experiments. Only if repeated experiments by other, independent researchers, have results that support the hypothesis, can such knowledge be said to be ‘scientific’. – Martin Hanson

Ironically, it didn’t seem to have occurred to Hendy, Wiles and their supporters, that in their extreme reaction to the Listener letter they were doing a far more effective demolition job on the scientific merits of matauranga Maori than the restrained and polite efforts of the seven professors. They seem to have conveniently forgotten that what most clearly separates science from myth and superstition is the challenging of established ideas in rigorous, public debate. In seeking to prevent criticism and debate they were unwittingly admitting it was not science, but doctrine, thus by implication proving the professor’s case for them. – Martin Hanson

It’s all too easy to despair of the extent to which New Zealand science has become suffocated by matauranga Maori. Certainly, it’s difficult to see how it can be brought back from its present state. –

As I see it, the only way of forcing kiwis to realise how ludicrous is the incorporation of Maori mythology into the teaching of science would be to engineer a new Scopes-type trial, for which we’d need a volunteer to put his or her head on the block. All it would require of the ‘kiwi Scopes’ would be a few carefully chosen words to a science class, such as:

“To say that rain is the result of tears shed by the goddess Papatuanuku is fine in social studies, but to say that it’s science is rubbish or, to use Richard Dawkins’ more colourful phrase, ‘bollocks’”.

That should light the blue touch-paper all right. The government would have to choose between two equally painful courses:

- take the red pill and accept scientific reality or

- take the blue one, kowtowing to the Woke Inquisition, thereby inviting international contempt.

Even without a latter-day Scopes trial, the government would have deservedly painted itself into a corner. Either way, those of us who have long despaired for New Zealand science education can look forward with keen anticipation to the outcome. – Martin Hanson

The country has not got enough eggs. Our dairy could not get enough bread. Since ancient Rome, food shortages are a way to lose popularity.

This time next year, Christopher Luxon will be prime minister. – Richard Prebble

To win, Labour would have to suspend Parliament, illegally put Opposition MPs into home detention, close magazines, commandeer the airwaves for government announcements, have the Reserve Bank flood the economy with printed money and have a massive taxpayer-funded advertising campaign. Would the Government do that again? – Richard Prebble

Hamilton West indicates none of the antivax parties will make 5 per cent.

Winston Peters will not be the kingmaker. For his own selfish reasons, he gave us this Labour Government. – Richard Prebble

2023 will be challenging. Next winter, the health system will be overwhelmed. School pupils will continue to vote with their feet. With 45,000 active P users, no neighbourhood will be crime-free.

Co-governance is unworkable. Centralisation cannot deliver the promised results. The polytechnic reorganisation, the broadcasting amalgamation, and trying to run health from Wellington will be a series of trainwrecks.

Election year is no time to implement a massive compulsory unemployment insurance scheme – the job tax. Labour may postpone or just pass the legislation and make it an election issue. – Richard Prebble

2023 will reveal there has been fundamental change. New Zealand has always been a destination of choice for immigrants. Not anymore.

InterNations surveyed immigrants’ experiences. Out of 52 nations, New Zealand was ranked the second-worst country. Only Kuwait is worse. Immigrants are shocked by our cost of living and low pay. Immigrants tell me our schools, health system and crime were unpleasant surprises.

The Government treated new residents appallingly. During Covid, parents were split from their children for years.

The biggest advertisement for immigration is the immigrants’ experience. Today, they are saying “do not come”. Many are planning to leave. – Richard Prebble

Labour is dropping the immigration criteria, but is failing to attract immigrants we need.

Not only are we failing to attract the skills we need, but skilled Kiwis are leaving. Those who are staying are the ones our schools failed to teach. New Zealand is de-skilling. – Richard Prebble

Sex-based data tells us, for example, that girls do better than boys in higher exams; that women earn less than men; that men are more likely to die by suicide than women. This information allows government to develop targeted policies — but once men can easily and legally become women, and vice versa, it ceases to have any value. A sudden spike in suicide rates among women, or in boys achieving A grades, might be the result of individuals changing their legal sex. How would we know?

It is remarkable that a government would knowingly choose to undermine its own ability to make good policy — and even more remarkable that MSPs would vote for it. – Kim Thomas

So here are two big reasons that free speech is always valuable, and a third that’s particularly relevant for 2023.

The first is that we are meaning-seeking beings. Free speech allows us to discover sources of truth and meaning so that we can organise our lives around them. If we don’t do this deliberately, through the free exchange of ideas and beliefs, it will happen to us by default, as when we simply absorb current ideological fashions or whatever institutions like the state and the market tell us to think.

Passively absorbing ideas also stunts our development. A fully human life involves agency, the ability to make decisions that matter, which is supported by the ability to share and receive ideas and information.

Yes, this includes making mistakes and getting things wrong – and learning and growing in the process.

The second reason to value free speech is that it helps us to realise when we’re wrong and to make better decisions. No-one’s right about everything, so we need others to tell us where we’ve gone astray even when that might offend us or challenge our deepest beliefs.

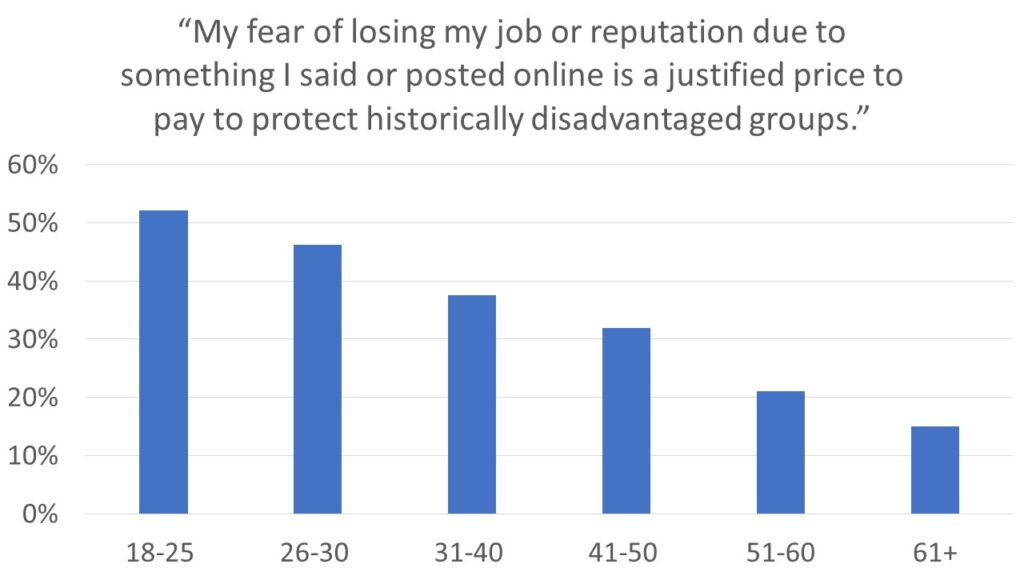

That’s why true viewpoint diversity leads to better outcomes. Unfortunately, New Zealand research reveals that too many academics are afraid to engage with sensitive topics like te Tiriti or gender, or even to raise differing perspectives. Not surprisingly, many Kiwi students are afraid to discuss similar issues in their lecture theatres.

Now consider that the media, which creates and maintains an essential part of the public square, are mostly drawn from the ranks of university graduates and increasingly see their role as “educating” rather than reporting. This creates a feedback loop or, less politely, an echo chamber which pushes questions underground and questioners to the margins of society, fuelling polarisation and social distrust.

The third reason to value free speech is that it helps hold us together as a society. This year we’ll have another general election. Some of us will get the outcome we want and some of us won’t. If we expect the losers to accept their loss gracefully or, at least, peacefully, we need to give everyone a fair shot at participating fully and making their case.

If some groups feel they have legitimate views that can’t be shared or that are met with hostility, they either won’t participate or won’t accept the outcome of the election. That’s how nations start to unravel.

Freedom has been described as “a very good horse to ride, but to ride somewhere.” In other words, freedom is not absolute; what it’s used for matters and there are limits to what we should tolerate. – Alex Penk

It’s important to debate the details of the Government’s bill and the Law Commission’s review. But we need to start by acknowledging not just that hate speech is bad, but that free speech is good. – Alex Penk

In 2023, political parties on the campaign trail will need to bear in mind that voters are newly sceptical of being promised something for nothing. And that if they were planning on fundraising by releasing NFTs, they should go back to the drawing board. – Ben Thomas

The benefit system was originally about providing secure income for those genuinely unable to work. That inability to work did not include causing one’s own incapacity or having dependent children.

It has since evolved to become a government tool for equalizing incomes between the employed and unemployed and advancing other ideological goals like the financial emancipation of the female parent from the male parent.

To some degree benefits have become an alternative source of income for those uninterested in the obligations and constrictions involved with being employed. Those who disagree with that statement argue nobody would willingly choose to live on a meagre benefit income.

That may hold water for single people. But the latest incomes monitoring report from MSD shows a couple on a benefit with two or more children receives over $800 weekly after housing costs. – Lindsay Mitchell

Until 2016 wage growth outstripped inflation hence the growing gap. Since 2019 benefits have been indexed to wages. Previously they were only indexed to inflation. Accordingly, the report notes the 2022 “main benefit increases reduced the gap”. That is, income from work became less attractive. – Lindsay Mitchell

So, the income support/benefit system is contributing negatively to the economy in that regard.

But worse, it is being used by the Prime Minister to achieve her primary goal of reducing child poverty.

According to the report, using Labour’s chosen measures which show percentage drops since 2017, she has been successful in this endeavour.

What is omitted from this report is the increasing number of children reliant on benefits.

Is this increase a reasonable trade-off for reducing child poverty? If the higher incidence of neglect and abuse for children growing up on a benefit is acceptable, then the answer is yes.

I disagree. The increase may even be described as the exploitation of children to make the Prime Minister look good. There is no reason why the welcome downward trend for state-dependent sole parents would have reversed bar financial encouragement. – Lindsay Mitchell

Asian households feature the lowest percentage of children experiencing material hardship – around 4% compared to the Pacific rate of around 24%

And yet when it comes to income support:

Eligible families with Asian parents had low estimated take-up in recent years. The late 2010s was a period of rapid growth in the Asian population of Aotearoa New Zealand. Low awareness, uncertainty about entitlements, administrative, personal and cultural barriers to claiming, or reluctance to claim payments among recent migrants may be factors explaining the trends.

So the benefit system cannot be credited with low Asian hardship. Something else is protecting their children. Probably the self-reliance and work ethic of their parents.

The government can fiddle all it wants robbing Peter to pay Paul under the guise of ‘fairness and equity’. But the downsides to this interference are corrupting incentives which will continue to blight New Zealand’s future. – Lindsay Mitchell

Potatoes aren’t particularly good swimmers and don’t like being submerged in water for long periods. – Chris Claridge

Won’t someone think of the feelings of paedophiles? It seems some public bodies have, and they are willing to change the language of their output to accommodate the sensitivities of this most dangerous group. Between Christmas and New Year’s Eve, Police Scotland were blasted for referring to those who abuse children as ‘minor-attracted people’, or ‘MAP’, in a report for a European Commission project. It seems that, just as fat people are now euphemistically referred to as ‘plus size’, and men in dresses have been rebranded as ‘transwomen’, child abusers are considered, by some, to be just another minority whose preferences deserve respect. – Jo Bartosch

Notably, MAP is the word preferred by groups who campaign to remove the ‘stigma’ associated with adults who want to sexually abuse children. It is a term often used by dangerous people who believe they have been victimised by a hostile society. It must be resisted. – Jo Bartosch

More recently, the odious euphemism has been given a veneer of scholarly legitimacy by academics. It seems fair to assume that organisations aiming to remove the stigma of paedophilia are influencing policy. Who exactly advised the European Commission to adopt this kind of language remains a mystery, but there are several organisations that push it. – Jo Bartosch

Perhaps universities are a soft target because people who work in the realm of ideas are more likely to be detached from their real-life consequences. In a lecture hall, to talk of paedophiles as a stigmatised, marginalised minority might simply sound edgy rather than dangerous. It might even attract grant funding. But for victims of child abuse, these matters are not simply theoretical.

The academic war on ‘stigma’ of all kinds makes it easier to sneer at anyone who tries to warn about the influence of paedophiles on public bodies. They can be dismissed as hysterical and backward. Ironically, to be seen as judgemental or morally absolutist carries the heaviest stigma today. – Jo Bartosch

This time there is a greater risk that paedophilia could be successfully rebranded. A cadre of queer-theory-addled academics seem to believe that all social barriers exist to be destroyed. Today’s abundance of pornography is also encouraging some people to seek out ever-more extreme sexual fantasies. Meanwhile, many dangerous communities have emerged online, where disordered and depraved individuals anonymously seek each other out and build cultures based on abuse.

It is hard to avoid the feeling that society is now primed for this last taboo to fall. And if it does, there will be those who cheer, and think the social acceptance of paedophiles is progress. Plain-speaking and honesty might be our last defence against this. We must reject the sanitising term ‘minor-attracted people’. This attempt to sugarcoat the reality of child abuse is profoundly dangerous. – Jo Bartosch

The one prediction I am truly confident in is that we will never know what the future holds.

Like those economists who’ve predicted six of the last two recessions, forecasting is a mug’s game. You might as well drive a car blindfolded and get instructions from a person looking out the rear window.

Best to focus on what we are uncertain about, and what we can fix today. – Josie Pagani

Mass hysteria is the spontaneous manifestation of a particular behaviour by many people. There are numerous historical examples: Middle Age nuns at a convent in France spontaneously began to meow like cats; at another convent, nuns began biting one another. In 13th-century Germany, spontaneous dancing broke out and entire city populations danced until exhausted. But perhaps the best-known mass hysteria was the Salem Witch Trials, where people, seized by visions, accused others of bewitching them. Many were executed.

But hysteria episodes are not only historical. They have occurred in modern times as well. Remember the daycare panic of the 1980s, when daycare workers were accused of horrible crimes against children, including satanic abuse. Many falsely accused spent years in jail. Lives were ruined. The strangest thing about that mass hysteria is that it spanned continents. – Brian Giesbrecht

Could it be that some of us are even now victims of self-induced mass hysterias?

For example, what are we to make of the insistence that a man who chooses to live as a woman actually becomes a woman? To most of the world this claim is nonsensical. It is neither scientific nor factual. A woman has XX chromosomes, while a man has XY. Case closed. But to others, a man actually becomes a woman simply by stating that s/he is one. In the future, will this strange thinking be considered a mass hysteria? – Brian Giesbrecht

And are the most extreme of today’s anti-fossil fuel exponents caught up in some version of a mass hysteria? I’m not referring to people with legitimate concerns about global warming and the need to find cost-effective, non-polluting energy. I mean those who insist that everyone must give up all fossil fuels by a date they invent. Will history judge this to be a hysteria? – Brian Giesbrecht

If you never crowed in public that you have more hair than your baldy bro. If you wished your widowed dad joy with his new partner rather than begged him not to remarry. If you have more tact than to tell your sleepless sister-in-law she has “baby brain”. If you keep your drug and virginity yarns for private late-night laughs. If you didn’t miss your grandmother’s last moments because you were arguing about travel plans. If you can resolve a brotherly beef without an unseemly bundle or, having had one, not speed-dial your shrink.

If you disdain the wittering of psychics, can tell greedy sycophants from loyal counsel and, above all, cherish loving friends who sometimes tell you to shut up for your own good, then you are better than those who live in royal palaces. Take a bow. – Janice Turner

The final version of the New Zealand History Curriculum contained no significant changes in spite of widespread concerns. The consultation process was an exercise in window dressing. The review panel was stacked, dissenting historians were silenced, the terms of reference limited, the period of consultation constricted, and the outcome predetermined.

What has been produced is not a “history curriculum” as such. What has been produced is a perspective on history that is fundamentally based on Critical Race Theory. – Caleb Anderson

We should not be concerned that there are controversial ways of looking at history, debate is the lifeblood of the historical method. But alternative perspectives can be deliberately suppressed for personal or political gain, and in order to advance one perspective alone, creating the impression that alternative perspectives are not credible. As a consequence, critical knowledge is cast to the wind, perspectives become untethered from the events which gave rise to them, and the deliberate selection of some facts, and denial of others, can create questionable conclusions, unbalanced views, and unjustified causes.–

Being open to alternative perspectives forces the consideration of inconvenient facts. This is how ideas are sifted, shaped, refined, tested, some last and some don’t. Legitimate historical inquiry is a natural bulwark against extreme ideas and intentional manipulation. Of course, history practiced legitimately is something of a rough and tumble exercise, you can be confronted with perspectives you find offensive, and you may have to concede or modify a position in light of new facts. But there are nearly always reasons why some facts are left out, or understated, and why some are included, and sometimes overstated. When critiquing a historical perspective, it is often a very good starting point to ask yourself precisely which critical information is left out, there is always a reason for this. –

With respect to colonisation, we are never told that intertribal slavery existed in almost every colonised land prior to colonization, or that the earliest slave traders were not the nations of Europe, or that tribal groups often lived in perpetual fear of their more powerful and ambitious neighbours, or that colonisation was sometimes a lifeline to smaller tribes fearful of annihilation at the hands of larger tribes.

We are not told that traditional societies were generally highly stratified, with almost no upward mobility, that tribal life was often brutal and short, that cannibalism was sometimes practised, that pantheistic and spiritualistic religions made people fearful, that primitive and labour-intensive technology exposed people to a life of toil, and regularly to the vagaries of famine.

We are not told that sometimes the colonising powers were very reluctant colonisers, that a piece of land purchased by a settler may have been paid for at least a dozen times to multiple owners, that missionaries and foreign service officials were often the most ardent advocates for the protection of indigenous people, that the punishment of indigenous children for speaking their native language at school was often at the behest of their parents.

We are seldom told that the anglo nations were the first in the world to legislate against slavery, that colonisation brought advantages … more comfortable homes became possible with the arrival of nails, written language with the arrival of the alphabet, warm clothing and blankets with the arrival of textiles, better diets with the introduction of new crops, more accountability (and justice) with the arrival of a legal system, a more coherent set of propositional ethics with the arrival of Christianity. It is easy to trivialize these things from our twenty-first-century perspective, but these changes yielded no small gain, and help to explain the eagerness of many colonised people to engage with the colonisers. – Caleb Anderson

Colonisation was often, and ultimately, a brutalising process, and the impacts of colonisation endure. But the history of the world is one of constant colonisation, of the over-layering of people groups, of subjugation and integration, and worse, over and over again. There are almost no exceptions to this. People moved when they needed to, and displaced others when they could. Stronger tribes prevailed, and weaker tribes were assimilated, enslaved, or exterminated. Similarly, the nations of Europe emerged from tribal beginnings and, as a result of often protracted territorial conflicts between these tribes, national borders emerged.

Colonisation is a manifestation of the outworking of universal principles, and reflects powerful human instincts to survive at a minimum, and to thrive at best. Judgment of historical realities needs to be tempered with a realistic, and balanced, vision of human nature, not a myopic and idealised one, and not one which attributes vice almost exclusively to some, and virtue almost exclusively to others. The proposed new curriculum is not a balanced presentation of the facts, but a cut-and-paste justification for an unbalanced and agenda-ridden view of history. Its core assumptions are selective and highly challengeable.

If anything, history teaches us that we are not so different from those who have come before us, or from those who inhabit a different part of our planet. We have similar motivations, good and bad. Individually, and collectively, we repeat the sins of earlier generations, nuanced and rationalized to our time and context, and commensurate with our ability to do so. We can be cruel when the opportunity for gain presents, when our interests are threatened, or when we are fearful. We sin against others, not always in equal measure, but we sin against them nevertheless. The same precipitating motivational drivers exist for us all, adjusted only to scale and circumstance. This should create within us a reluctance to point our fingers. It is sometimes right to seek redress, but we should be honest about the actions of our forebears too, we should not rest our arguments on convenient facts alone, and sweep inconvenient facts under the carpet.

Radical re-sets, always accompanied by a historical cut and paste exercise, usually do not go well, and can be ultimately catastrophic. – Caleb Anderson

Perhaps worst of all, in the grip of something akin to a mass psychosis, people began to turn on each other. Knowing what happens when ideas are pushed to (or beyond) their limits (which invariably happens when competing perspectives are disregarded) gives us a taste of how badly things can actually turn out. We could never end in such a place, how sure are you of that?

Repeated comments by the Maori Party, and others on the left of politics, that Maori were subjected to genocide, and a holocaust, are an object lesson in where you can end up when you play loose with the facts of history, and when you can come to believe your own lies. What do they know, if anything, of the experience of the Jewish people throughout the ages? To equate the planned, systematic extermination of six million Jews with the colonisation of New Zealand is unforgivably ignorant. Loose-lipped commentators in the United States have been stood down, and forced to apologise, for anti-semitic comments of lesser magnitude than this, and yet the New Zealand media have barely commented, or challenged, such baseless assertions, it largely passed without notice, more than once

In short, history is impossibly complex, as are the people it seeks to represent. As there is no truth, but many truths, there is no history but many histories. Thus what makes history exciting, is also what makes it prone to abuse. The new curriculum is not a history curriculum in any valid sense. It is a selective view of the past, based on questionable assumptions. The new curriculum seeks to enshrine Critical Race Theory as the primary lens through which we make sense of past and present realities. It silences dissenting views, narrows perspectives, pits people groups against each other, attributes vice to some and villainy to others, and contaminates our national consciousness.

Perhaps worst of all it contravenes the duty of all educators to ensure that their students have a right to their own worldview, to question without fear, to seek the fuller picture, to ascertain motive, and to weigh in light of broader considerations. In short, our students have a right to be free from indoctrination by those who have no tolerance for those who see things differently or who are easily offended.

Critical Race Theory is cleverly hidden throughout this insidious document but it is there nevertheless, the subtle twists of phrase, and the occasional concessions to good sense, make it all the more dangerous. All indications are that this government will muster every mechanism at its disposal to see that this document is implemented to the letter. Instructions to schools have been clear, and problematic books have already been removed from libraries.

Three Waters will not be this government’s legacy, The Aotearoa NZ History document will be its true legacy. As they are consigned to the opposition benches, as they soon will, the left will console themselves that the seeds have been planted … in our institutions, in our schools, and in the minds of the most impressionable, and it is only a matter of time before they will get to water these seeds again. With the left, it is always the long game that counts. – Caleb Anderson

History done well is an adventure, if done poorly, it is best left alone! – Caleb Anderson

By now most of New Zealand’s public is aware of co-governance, Three Waters and efforts to normalize the Treaty of Waitangi as central to much of New Zealand life and society. In this multi-cultural nation that we have become, it is critical that we respect Māori, and value the good things that Matauranga Māori has achieved for Māori over centuries, but stand firmly against any movement that attempts to place one ethnic or cultural group above others. Our entire society cannot, and should not, be re-configured to enforce the world view of one small, self-identifying minority. Nor should we give ourselves over to the notion that traditional knowledge is somehow the equal of modern science.

How many of the general public are aware of what is happening in education right now? We should be deeply concerned about the refresh of the national curriculum currently in progress within the Ministry of Education and related organizations. The proposed new curriculum is referred to as Te Mātaiaho: A draft Te Tiriti-Honouring and Inclusive Curriculum Framework. We are told that Mātauranga Māori will sit at the heart of the learning areas and that key competencies, literacy and numeracy, will be woven explicitly into each learning area. (Ministry of Education, 2022a) – David Lillis

The entire initiative very frightening indeed, especially the dishonesty whereby we are being led to believe that a Treaty-based curriculum is for everyone and that all of us must get on board. The arrogance and, indeed, deceit and bullying of those three activists and others in forcing a retrograde agenda on all students in New Zealand, regardless of social, ethnic or religious background, for decades to come is more than astonishing and we must now stand up to them and to a Ministry of Education that is complicit in perpetrating a highly-dangerous falsehood. – David Lillis

Sorry – but the refreshed curriculum certainly does not better reflect the aspirations and expectations of all New Zealanders. Quite clearly, the agenda is to empower one ethnic group and bully everyone else into submission and we must not allow ourselves to be taken in by the accompanying misleading and, frankly, dishonest rhetoric. – David Lillis

Again, sorry – but the curriculum refresh panders to activists from a small minority and must be resisted at all costs. If we fail, then several generations of New Zealand students, from all backgrounds, ethnicities, religions and cultures, are going to have this agenda forced on them every day of their primary and secondary education. Pacific students, Asian students, Pakeha students and indeed, Muslim immigrants from North Africa and the Middle East, including those fleeing violence in Syria, the Ukraine and parts of Africa, will be forced to absorb the language and traditional knowledge of one self-identifying ethnicity and cultural group as a significant part of their primary and secondary education.

We are told that the current curriculum disadvantages Māori. Does it? Why? Where is the evidence? Māori underperformance in education does not emerge from the curriculum, but instead results mostly from unfavourable socioeconomics. If the curriculum disadvantages Māori, then does it not also disadvantage Pacific students and others? Why only Māori?

The issues for Māori and others are not hurt and pain because of denigration of mātauranga Māori, but rather the validity of indigenous knowledge, including mātauranga Māori, embedded across an entire curriculum, but especially as an alternative to modern science that can be taught in science class. – David Lillis

Always, socioeconomics emerges as a significant predictor of performance (and, indeed, underperformance), while ethnicity becomes largely non-significant. – David Lillis

We may or may not agree with the stated intent of the curriculum refresh to honour matauranga Māori, but should not the primary aims of any curriculum be to support learning for all and enable students to acquire and develop the knowledge, know-how and skills that will enable them to compete in the domestic and international marketplaces? Never should it be the function of a national curriculum to support the nation’s constitution, treaty or other founding document or, indeed, to ensure equality of outcomes. Instead, the objectives should be the support of equality of access and opportunity and to underpin first-class education that enables students to learn and succeed. – David Lillis

Teaching students of science that a special force exists within inanimate things constitutes willful neglect of duty on the part of Government and the relevant Ministries, compromises the education of future students and will bring our national science curriculum and, indeed, the entire NCEA system into disrepute.

Of course, in daily life today we don’t take myths and legends as truth but we do recognize that they are important for the descendants of indigenous people and are part of the great history of mankind. However, we are coming dangerously close to teaching such concepts as truth to young and impressionable children within our revised national primary and secondary curriculum. – David Lillis

Only good can come of teaching our children to respect the views of others. Some class time devoted to Te Reo and Māori culture and history will give all New Zealanders a greater appreciation of Māori culture, their history and their very significant contributions to the New Zealand of today. It stands to reason that we should also introduce students to Pacific cultures, Asian cultures, African cultures and the cultures of Islamic immigrants from the Middle East.

Both Te Reo and Mātauranga Māori should be treasured and preserved. However, imposing large proportions of class time to Te Reo and Mātauranga Māori to all learners, especially if presented as science, must be opposed, given other demands on children’s lives and given a noticeable decline in New Zealand’s recent academic rankings relative to those of other nations (see, for example, Long and Te, 2019). Our children must acquire not only qualifications, but the skills and knowledge that are obligatory if they are to compete in tomorrow’s New Zealand and international marketplaces. – David Lillis

The assertion of systemic bias or racism as a cause of disparity, and thereby providing justification for major policy and legislative change, is evident in domains other than education; for example, in public health and employment in the sciences and academia generally. However, the extent of systemic bias within these domains is difficult to determine objectively and could only be evaluated through research rather than anecdote. Possibly, in many jurisdictions systemic bias acts in favour of minorities, rather than against them, but indeed we must be vigilant in identifying bias and countermanding it wherever it occurs. – David Lillis

Nor should disparate outcomes provide a sole justification for significant change that clearly is intended to benefit one group disproportionately, when other demographic groups are also disadvantaged. Thus, not only Māori have poorer outcomes in education, but also Pacific people and, reviewing the official statistics on health and wellbeing in New Zealand, we see that Pacific people are even more disadvantaged than Māori on certain indices (Lillis, 2022). But Pacific people will not receive a dedicated health ministry within the foreseeable future and nor will anyone else who is non-Māori. – David Lillis

I repeat what I have said before – labels such as racism, systemic bias, conscious and unconscious bias and colonialism have some traction. However, not only may such labels be applied without justification, apart from anecdote, but possibly they may detract from our efforts to address the real causes. The true agents of disparity, principally socioeconomic in nature, may lie largely outside the jurisdictions of education, health and science, and we have duty of care to address those causes.

Finally, conferring special privilege to one ethnic or cultural group will not repair inequality; nor will consuming scarce resources to address structural racism and bias if these factors are small, or in practice no longer present, and if the core structural and systemic problems lie elsewhere.

We must resist the curriculum refresh with all our might. Future generations of New Zealanders are depending on us. – David Lillis

For most of the last century, the “progressives” have been taking over the nation’s education system at every level. Pick any teacher, professor, or administrator and the chances are high that he or she is utterly dedicated to the Leftist project of replacing our liberal (in the true sense of the word) society with their vision of a properly regulated one. By controlling education, the Leftists implant the ideas they favor into students (including collectivism, egalitarianism, and acceptance of authority) while at the same time repressing ones that work against them (such as individualism, skepticism of authority, and belief in the spontaneous order of liberty).