On February 25:

138 The Emperor Hadrian adopted Antoninus Pius, effectively making him his successor.

1570 Pope Pius V excommunicated Queen Elizabeth I.

1778 José de San Martín, Argentine general and liberator of South America, was born.

|

1793 George Washington held the first Cabint meeting as President of the United States.

|

1797 Colonel William Tate and his force of 1000-1500 soldiers surrendered after the Last Invasion of Britain.

Carregwastad Head, the landing site for Tate’s forces

Carregwastad Head, the landing site for Tate’s forces

1836 Samuel Colt received an American patent for the Colt revolver.

1841 Pierre-Auguste Renoir, French painter, graphic artist and sculptor, was born.

1845 George Reid, fourth Prime Minister of Australia, was born.

1861 Rudolf Steiner, Austrian philosopher and educator, was born.

1870 Hiram Rhodes Revels becamethe first African American to sit in the U.S. Congress.

1873 Enrico Caruso, Italian tenor, was born.

1890 Dame Myra Hess, English pianist, was born.

1890 Vyacheslav Molotov, Soviet politician, was born.

1901 Zeppo Marx, American actor, was born.

1901 J.P. Morgan incorporated the United States Steel Corporation.

1908 Frank G. Slaughter, American novelist, was born.

1912 Marie-Adélaïde, the eldest of six daughters of Guillaume IV, becomes the first reigning Grand Duchess of Luxembourg.

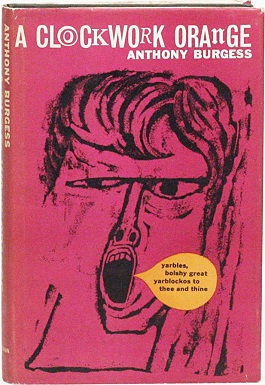

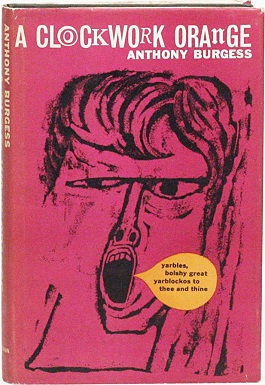

1917 Anthony Burgess, English author, was born.

1919 Oregon placed a 1 cent per U.S. gallon tax on gasoline, becoming the first U.S. state to levy a fuel tax.

1921 Tbilisi, capital of the Democratic Republic of Georgia, was occupied by Bolshevist Russia.

1925 Glacier Bay National Monument (now Glacier Bay National Park and Preserve) was established in Alaska.

1928 Charles Jenkins Laboratories of Washington, D.C. became the first holder of a television license.

1932 Adolf Hitler obtained German citizenship by naturalisation, which allowed him to run in the 1932 election for Reichspräsident.

1933 The USS Ranger (CV-4) was launched, the first US Navy ship to be built solely as an aircraft carrier.

1935 Sally Jessy Raphaël, American talk show host, was born.

1941 February Strike: In occupied Amsterdam, a general strike was declared in response to increasing anti-Jewish measures instituted by the Nazis.

De Dokwerker in Amsterdam remembering the February strike

De Dokwerker in Amsterdam remembering the February strike

1943 48 Japanese prinsoners and one guard were killed in the Featherston Prinsoner of War riot.

1945 Turkey declared war on Germany.

1946 Jean Todt, French executive director of Scuderia Ferrari, was born.

1947 State of Prussia ceased to exist.

|

1948 The Communist Party took control of government in Czechoslovakia.

1950 Néstor Kirchner, President of Argentina, was born.

1951 The first Pan American Games were held in Buenos Aires.

1953 José María Aznar, former Prime Minister of Spain, was born.

1954 Gamal Abdul Nasser was made premier of Egypt.

1956 In his speech On the Personality Cult and its Consequences Soviet leader Nikita Khrushchev denounced the cult of personality of Joseph Stalin.

1971 The first unit of the Pickering Nuclear Generating Station, first commercial nuclear power station in Canada, went online.

1973 Julio Iglesias, Jr., Spanish singer, was born.

1976 Chris Pitman, American keyboardist (Guns N’ Roses), was born.

1980 The Suriname government was overthrown by a military coup initiated with the bombing of the police station from an army ship of the coast of the nation’s capital; Paramaribo.

1985 Benji Marshall, New Zealand rugby player, was born.

1986 People Power Revolution: President Ferdinand Marcos of the Philippines fled after 20 years of rule; Corazon Aquino became the first Filipino woman president.

1991 Gulf War: An Iraqi Scud missile hit an American military barracks in Dhahran, Saudi Arabia killing 28 U.S. Army Reservists from Pennsylvania.

1992 Khojaly massacre: about 613 civilians were killed by Armenian armed forces during the conflict in Nagorno-Karabakh region of Azerbaijan.

Memorial to the victims of Khojaly Massacre

Memorial to the victims of Khojaly Massacre

1994 Mosque of Abraham massacre: In the Cave of the Patriarchs in Hebron Dr. Baruch Kappel Goldstein opened fire with an automatic rifle, killing 29 Palestinian worshippers and injuring 125 more before being subdued and beaten to death by survivors. Subsequent rioting kills 26 more Palestinians and 9 Israelis.

2009 BDR massacre in Pilkhana, Dhaka, Bangladesh. 74 People were killed, including more than 50 Army officials, by Bangladeshi Border Guards.

Sourced from NZ History Online & Wikipedia

Posted by homepaddock

Posted by homepaddock